How To Avoid Stamp Duty On Second Home

One is also exempt in conditions when the property has been transferred following a divorce or separation after the end.

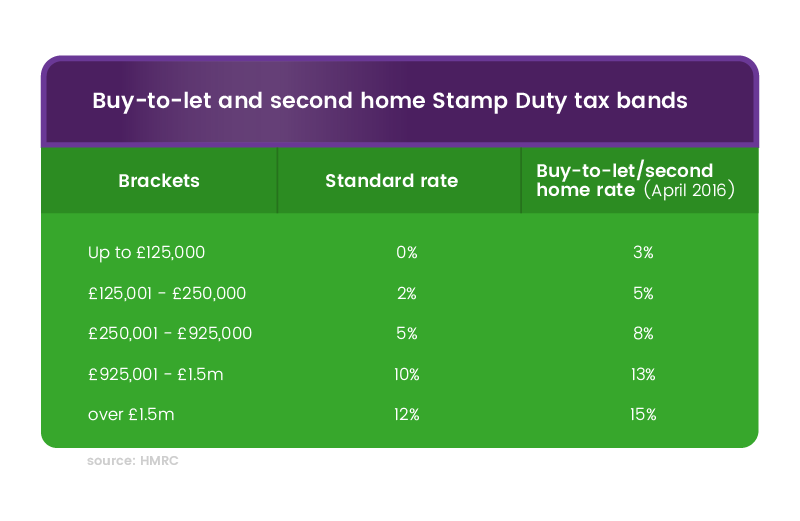

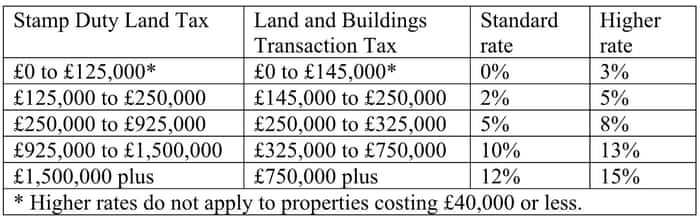

How to avoid stamp duty on second home. The loan agreement takes 24 hours to draft and can include interest terms and when to repay. But if this is your second property the stamp duty owed will be 8 396. You sold your old main residential property within three years of purchasing your new main residence.

Married couples and civil partners who separate in circumstances that are likely to be permanent will not have to pay the higher rates of stamp duty a surcharge of 3 above the current rates when one of them buys a new home before the family home has been sold transferred. With effect for purchases completing after 26 november 2018 the legislation imposes a three yeartime limit by which the purchase of your next only or main residence should be completed following the sale of a former only or main residence if you are to escape the 3 surcharge. Get a loan agreement quote.

You can gift the home to others and if you are not the joint owner of the property the rule of duties on the second. According to the most recent land registry figures the average house price in the uk is 217 928. You can avoid paying stamp duty on a second home if it s worth less than 40 000.

This reduces the price of the property which in turn reduces the amount of stamp duty you owe on it. Buy a cheap home. But good luck trying to find one of those.

When you re considering putting an offer on a house you should consider what the stamp duty will work out as. In most states and territories stamp duty is applied on a sliding scale just like income tax. You should not be tempted to inflate the value of the fixtures and fittings however.

You may also be exempt if you inherit a 50 or less share of a property. That means the cheaper your property the lower your real rate of stamp duty will be regardless of what type of buyer you are. You paid stamp duty for the second home by mistake.