Take Home Pay After Taxes Georgia

Calculates federal fica medicare and withholding taxes for all 50 states.

Take home pay after taxes georgia. We ll do the math for you all you need to do is enter the applicable information on salary federal and state w 4s deductions and benefits. Calculate your georgia net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local w4 information into this free georgia paycheck calculator. Paid by the hour.

Use gusto s salary paycheck calculator to determine withholdings and calculate take home pay for your salaried employees in georgia. Your average tax rate is 22 10 and your marginal tax rate is 35 65 this marginal tax rate means that your immediate additional income will be taxed at this rate. Social security and.

Your average tax rate is 22 08 and your marginal tax rate is 35 98 this marginal tax rate means that your immediate additional income will be taxed at this rate. Use smartasset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Overview of federal taxes when your employer calculates your take home pay it will withhold money for federal income taxes and two federal programs.

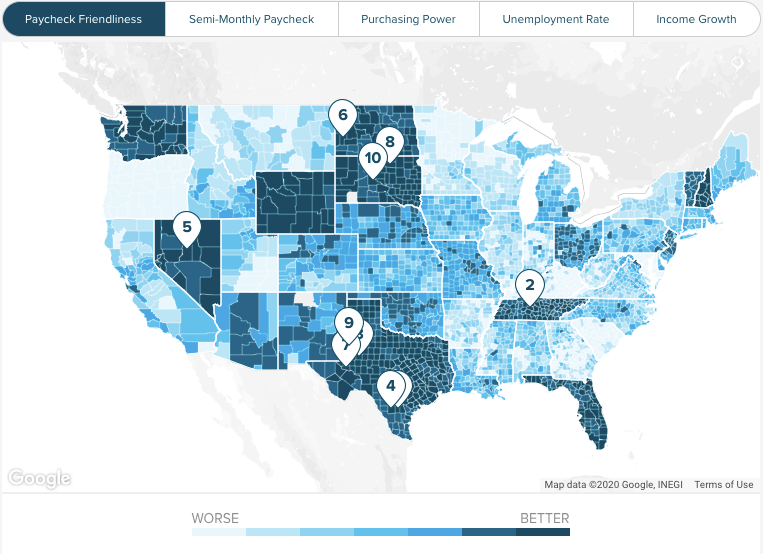

This free easy to use payroll calculator will calculate your take home pay. Overview of georgia taxes georgia has a progressive income tax system with six tax brackets that range from 1 00 up to 5 75. Use smartasset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

If you make 55 000 a year living in the region of new york usa you will be taxed 12 144 that means that your net pay will be 42 856 per year or 3 571 per month. Check out our new page tax change to find out how federal or state tax changes affect your take home pay. Supports hourly salary income and multiple pay frequencies.

The easiest way to achieve a salary increase may be to simply ask for a raise promotion or bonus. However this is assuming that a.